Disney’s stock (DIS) price has continued to fall over the past few weeks, dropping the price to a near 5-year low. The stock price entered the Memorial Day Weekend at $88.29 per share. DIS started May 2023 at over $100 per share, but has been falling steadily all month.

The stock price for Disney is just a handful of dollars above the mid-$80s prices shareholders saw when Disney closed its parks and resorts in March 2020. Disney stock roared back to life just a year later on streaming optimism, topping out at over $200 per share in March 2021.

Disney’s stock performance over the past five years:

The tumbling stock price comes as Disney slashes costs around its many operations. The cuts have included layoffs, removing content from Disney+, and even closing the Star Wars: Galactic Starcruiser. The tightening budgets haven’t been enough to renew shareholder confidence at this time as fears over streaming losses remain.

Disney’s Parks and Resorts, a major bright spot in terms of company revenue, is about to face its own significant challenges. Walt Disney World attendance is expected to dip during the normally busy summer months. Disney has attempted to counter this by offering new perks to its Walt Disney World annual passholders and select resort discounts, which some consider a canary in a coal mine type of warning sign.

Guests at Disney parks have complained that the experience has become too expensive and too complicated. Disney Genie+ has only further complicated things. Nickle and diming policies, some of which were instituted under former CEO Bob Chapek, have caused an unknown about of damage to the brand.

Meanwhile, Disney hasn’t started construction on any major U.S. park additions outside of what’s left on the Journey of Water walk-through attraction and the center spine changes at EPCOT. Neither of those are likely to boost attendance. Any significant addition to either Disneyland or Walt Disney World sits several years away – and that’s if construction started immediately. Disney’s decision to delay investing in the asset (the theme parks) that drive much of the company’s profit remains mystifying.

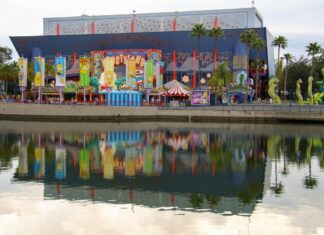

The competition isn’t sitting by while Disney enters a period of stagnant park expansion. In Orlando, Universal is preparing to open a brand new theme park in 2025. Universal is steadily improving its theme parks in the Orlando area and making more guests question why Disney doesn’t seem to feel threatened.

What’s next for Disney’s stock? The company plans to bring back a dividend at some point in 2023, though they’ve noted it will be a smaller dividend than what shareholders saw in the past. Questions loom over who will be the next CEO of Disney with current CEO Bob Iger still reportedly planning to exit in 2024. Additional questions surround Disney’s political battle in Florida. Disney may need to find answers to these questions – and many others – before things turn around.